Limited Company or Sole Trader Which Is Best for Me

Personally you would be a Director and shareholder of your Limited company. One of the biggest benefits of having a limited company.

Should I Own My Property Through A Limited Company Or As A Sole Trader The Accountancy Partnership

Rather than shelling out for income tax limited companies instead pay corporation tax.

. Here are the main ones that are most likely to. This is usually more tax-efficient than being a sole trader as you can have a salary and dividends. Next youll need to decide whether to set up a new limited company or register as self-employed.

If youre a one-man show and your business is still in its infant stages Sole trader status is probably your best bet. For most private business owners self-employed workers and freelancers the choice comes down to operating as a sole trader or a limited company. This means that depending on the level.

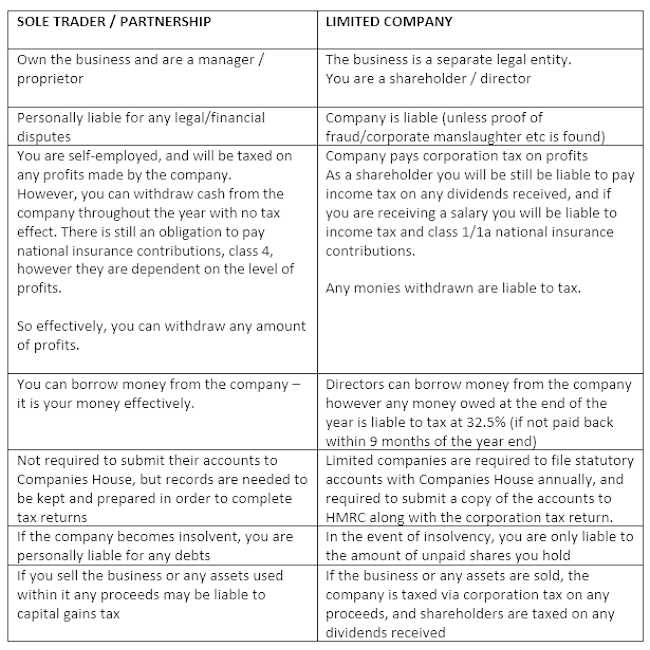

The sole trader legal structure differs from that of limited companies in several key ways. However once you get things up and running youll definitely. A limited company can only offset its trading losses against other company income but not against your income as a shareholding director.

If you do choose to go self-employed this could be either as a sole trader or as. Whether you run your business as a sole trader or as a limited company should come down to. Running a limited Company means more paperwork.

Unlike the sole trader route a. However a limited company has to file. So youve made the decision to move away from the employed life and become self employed.

The Corporation tax rate is currently 19. There are a number of differences between being a sole trader and setting up a limited company which have legal and financial implications. Here is why a limited company structure may be better for you than becoming a sole trader.

Sole traders only have one document to file with government bodies each year. Running a limited company is. Limited companies currently pay 19 corporation tax on profits compared to 20-45 income tax paid on sole trader profits.

Sole traders on the other hand cannot seek investment unless they go through the. Setting up a Limited company may be the best option if you are a well established Sole Trader with rising profits. In addition to this.

As a sole trader you. Limited companies are liable for Corporation Tax on their business profits. Its not as if one is superior than the other.

1 set up a. Limited company directors stand to be more tax efficient that sole traders as rather than paying Income Tax they pay Corporation Tax on their profits. The sole trader would work for me quite well.

Limited companies tend to benefit from lower levels of taxation than that of sole traders. As a limited company you will be able to sell shares in your business to an investor relatively easily. Think about how much money you make and if this is likely to be higher than.

When it comes to self employment there are three main options. A sole trader is self-employed and owns and runs a business as themselves. A limited company has got lots of.

The corporation tax rate is slightly more favourable at 19 compared to 20 for income tax rates at that sole traders are subjected to. It is easy to start and close down all the profits belong to me keeping of records and books of accounts. Sole trader or limited company.

Reinvesting profits instead of withdrawing the full extent of.

Working Through A Limited Company Low Incomes Tax Reform Group

Limited Company Or Sole Trader Which One To Choose Tide Business

A Guide To Deciding Between Sole Trader V Limited Company V Umbrella

Limited Company Uk Vs Sole Trader Uk Which One Is Right For Your Self Employed Business Idea Youtube

Sole Trader Partnership Llp Or Limited Company

Sole Trader Vs Partnership Vs Limited Company

What Is A Good Example Of A Sole Trader Quora

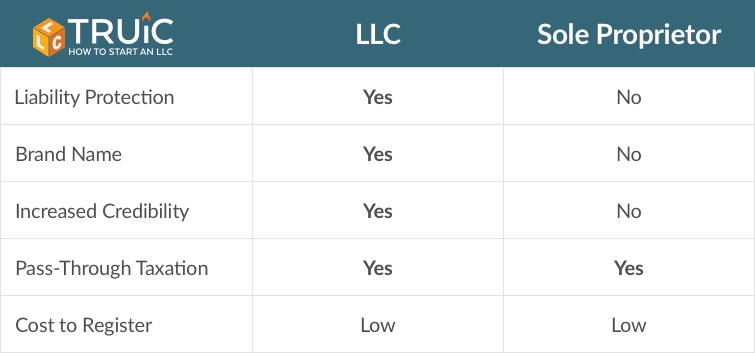

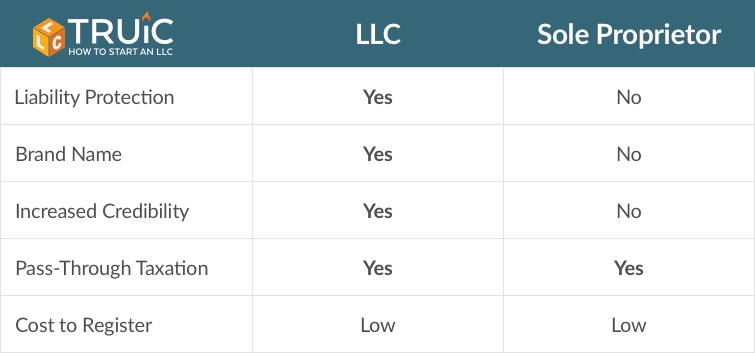

Difference Between Llc And Sole Proprietorship Truic

Limited Company Or Sole Trader Clearsky Accounting

Sole Trader Or Limited Company Which Is Right For You

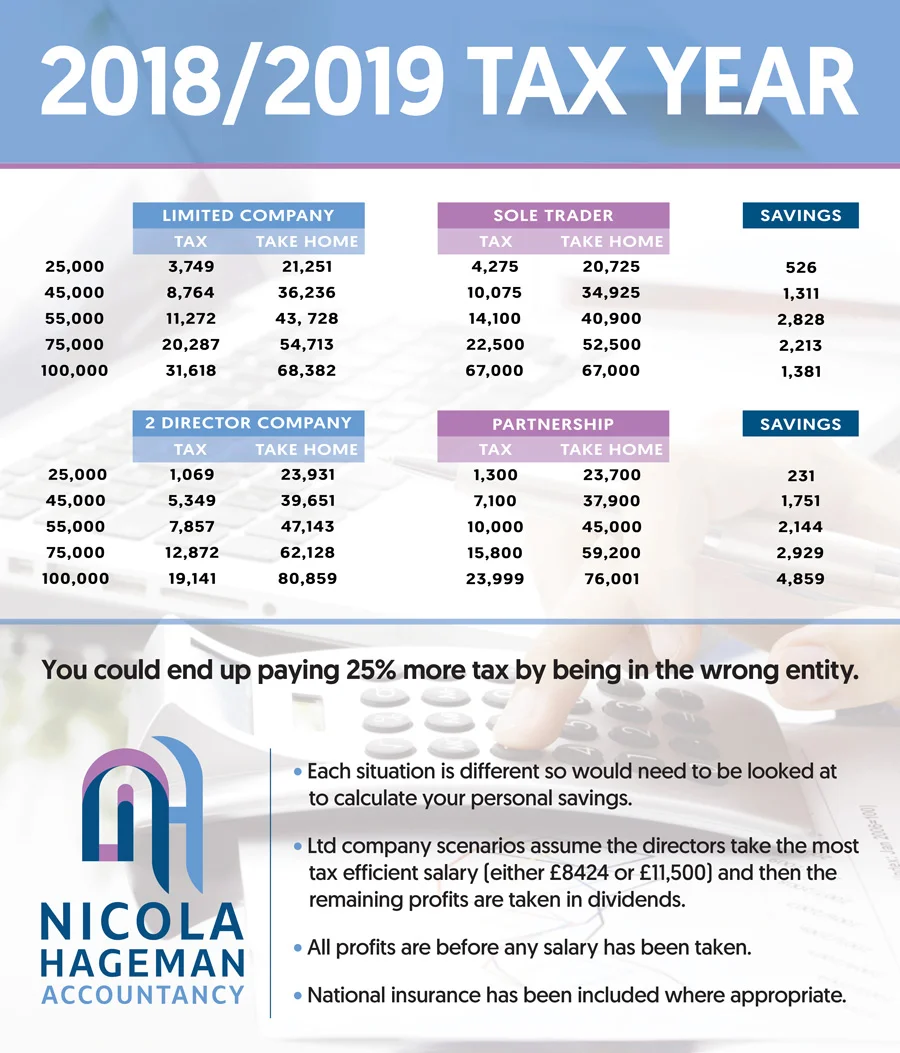

Sole Trader Or Limited Company Nicola Hageman Accountancy Bedfordshire

Convert Sole Proprietorship Into Private Limited Company Vakilsearch

Sole Trader Or Limited Company Which Is Right For You

Sole Trader Or A Limited Company

Sole Trader Or Limited Company A Guide To Help You Decide

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Video Sole Trader Vs Limited Company Ireland Accountant Pages

Nice article i also have blog on same niche Procedure for NSIC Registration click on it.

ReplyDelete